Wondering why insurers need your criminal record details? Get the answers here and stay protected

Searching for home insurance with a criminal conviction? Intelligent Insurance can help. We arrange high-quality home insurance for diverse personal circumstances, ensuring that individuals with criminal convictions find suitable cover.

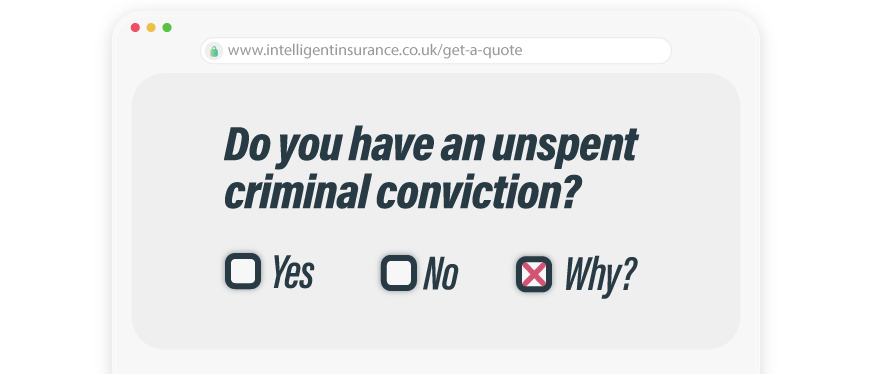

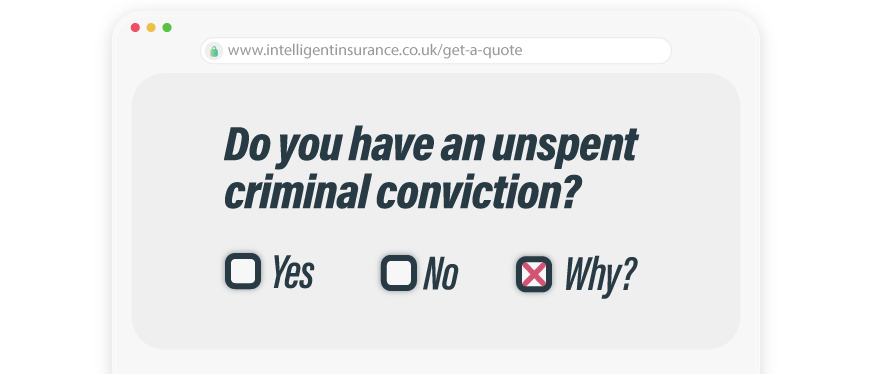

Understanding the nuances of your circumstances and criminal history is crucial for us to tailor the right coverage. Our user-friendly quotation process will guide you through a comprehensive set of questions, allowing you to accurately enter your conviction details and obtain home insurance with a criminal record in most cases.

Yes, Intelligent Insurance specialises in providing home insurance for individuals with unspent criminal convictions. We understand the unique circumstances and offer tailored coverage to meet your specific needs.

Our user-friendly quote and buy website guide you through a comprehensive set of questions. This allows you to accurately enter your conviction details, ensuring that we understand your situation and can provide suitable home insurance cover.

The ‘spent’ status depends on factors such as the nature of the conviction, the length of the sentence, and when it occurred.

Once a conviction becomes spent, you do not need to disclose it when insuring your home. However, it’s essential to be honest and answer any questions asked during the quote process.

Generally, motoring convictions like speeding fines are not required to be disclosed for home insurance. However, it’s crucial to read and answer all questions honestly to ensure accurate cover.

Yes, you can opt for contents-only insurance if that’s what you need. We understand that everyone’s situation is different, and you might be looking for specific cover for the valuables inside your home without the need to insure the building itself. Our contents insurance policies are designed to provide comprehensive protection for your belongings, even if you have a criminal conviction.

If you’re unsure whether your conviction is spent or unspent, you can use the Unlock Disclosure Calculator. This tool helps you determine the disclosure status of your conviction under the Rehabilitation of Offenders Act 1974. Understanding this is crucial, as unspent convictions must be disclosed during the home insurance quote process, while spent convictions do not need to be declared.

Intelligent Insurance approaches insurance cover with a smart, personalised touch. Understanding that each property and homeowner’s circumstances are unique, we tailor our policies to your needs.

This intelligent approach ensures that whether your home is a standard build, a listed property, or has unique characteristics, your insurance coverage is as individual as your home.

We’re committed to providing protection that adapts to your specific needs, offering peace of mind and comprehensive cover for both buildings & contents.

Family Legal Protection Plus extends this cover limit to £50,000 and increases the range of legal disputes that you’re covered for.

Enjoy complete protection with extended emergency callout cover with up to £1,000 per callout, £1,000 Total Claims Limit/Year, Boiler & Heating System cover & Alternative Accommodation

Cover for accidental breakages or damage to your buildings e.g: putting your foot through the ceiling, or accidental breakage of glass

Determining when a conviction becomes ‘spent’ involves considering the nature of the conviction, the length of the sentence, and when the incident occurred. Whether tried as a minor or an adult also plays a role. Once your conviction becomes spent, disclosure is not necessary when insuring your home.

While motoring convictions like speeding fines are typically not required to be disclosed for home insurance, it’s essential to read and answer all questions honestly to ensure accurate cover.

As we specialise in Non-Standard Home Insurance, we adopt an open-minded approach with all of our customers. We gather all relevant details to provide sensible home insurance quotes based on the facts of your situation.

Whether you’ve served time, received a fine, or completed community service, we strive to offer home insurance tailored to your needs, even if you have a criminal record.

If you are seeking home insurance with criminal convictions, contact Intelligent Insurance for a quote today. Our commitment is to provide understanding and inclusive coverage for individuals with unique circumstances.

As the trusted choice for homeowners or tenants with unique circumstances, we invite you to discover the difference with Intelligent Insurance. Let’s work together to secure your home insurance, ensuring that you’re protected with a policy that truly understands and meets your needs.

Get an online quote for your specialist home insurance, tailored to your needs

For help with your quote, use our online chat to speak with a member of our team

*We may not be able to quote in all circumstances. Cover limits/restrictions and/or conditions may apply to the policy. These are clearly detailed prior to purchase, and in the policy documentation for you to determine if the cover is suitable for your needs.

Browse our intelligent reading list of articles, guides and tips at your own convenience.

Wondering why insurers need your criminal record details? Get the answers here and stay protected

Let's guide you through the steps to securing home insurance with a criminal record.

Discover how Defaqto Star Ratings guide better insurance choices

“…Early days but so far great. Conscientious call backs. Also willing to insure despite a criminal record. Well reviewed on Trust Pilot and compares favourably to comparison sites. No experience of claims as yet…..”